There are several items you should make sure of. When looking for the SoFi alternative, the SoFi trading site you choose must have traded and features costs that align with your investing objectives and trading style.

We are here with a comprehensive record of the best SoFi alternatives, and challengers are also further divided on the SoFi competitors list. Suppose you're trying to find a trading platform with characteristics comparable to SoFi.

Moreover, we have provided the top SoFi alternatives below if you are searching for capabilities that SoFi fails to offer, but you need for trading. Of course, you want to look for more trading options, competitive SoFi fees, or superior customer support from a SoFi substitute.

So, let’s see the topmost Sofi invest alternative!

Explore These Incredible Sofi Invest Alternative

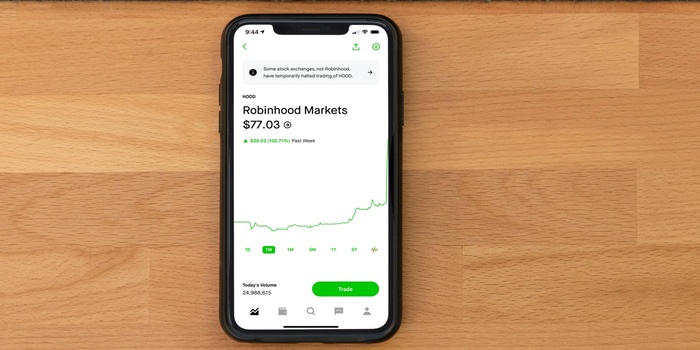

Robinhood

Robinhood is one of the SoFi Invest apps. It offers ETFs and zero-commission equities and also provides free commissions trading free of commissions options trading. In addition, Robinhood does not impose a per-contract charge on trading options, which is rare for many brokers.

It is ideal for starters. You may visit its site to gain access to a collection of informative articles about personal and investing finance topics. Unlike SoFi, however, Robinhood does not currently provide personal retirement savings accounts (IRAs) or an automatic investment platform.

Betterment

It is the best alternative to SoFi technologies investing. This robo-advisor suggests automated portfolios constructed from ETFs with low fees. It offers tax-loss harvesting, despite SoFi charging no management cost and Betterment charging a 0.25% fee.

This computerized method might reduce the tax burden associated with your investments. These are fiduciaries, and it is their legal duty to advise you on economic matters in the best interests of your situation.

Fidelity Investments

Fidelity investors provide ETFs and commission-free equities, just as sofi invest. However, Fidelity goes one step further by including commission-free trading options. Additionally, over 3,000 index products without expense ratios are available from Fidelity.

While Fidelity provides index funds, mutual funds, and options, SoFi does not. Fidelity offers advanced research tools to active traders, such as a stock screener with over 400 parameters and third-party research.

SoFi has fewer powerful research tools. But this alternative doesn't charge an administration fee for its automatic investment platform. An analogous option, Fidelity Go, levies a management fee of up to 0.35% on substantial amounts.

JPMorgan Automated

JPMorgan provides automated and active investing saving accounts. However, it achieves success in the race regarding research resources and tools. For Instance, you have entered the market research. You may use the view for detailed or stock screener forecasts.

You may view your investments through the mobile app, which ranked ideal in customer contentment for mobile app wealth management by J.D. Power. Though SoFi's automatic investing platform is fee-free, JPMorgan requires an annual management fee of 0.35%.

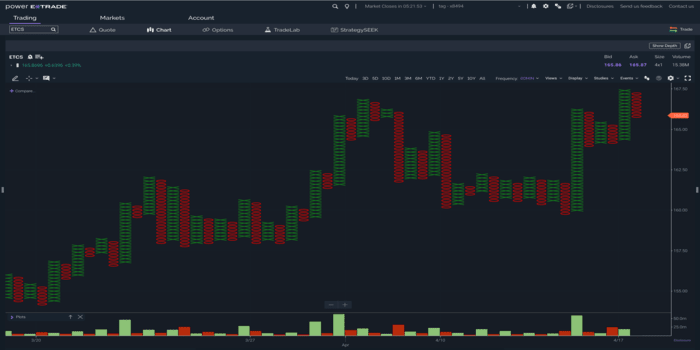

E-Trade

E-Trade, a full-service trading company, offers competitive prices like cheap brokers like SoFi.

E-Trade provides ETFs and commission-free goods. However, it gives lenders access to more certainty, including bonds, futures, and mutual funds.

It has free research tools for every customer, irrespective of their amount. Investors may view commentary live market, stock screeners, market data streaming, and many more along the E-Trade Website. It also offers the best features, such as risk-reward analysis and dynamic charting.

The best program also allows you to trade futures, options, equities, and ETFs. It also includes predefined scans and over 100 technical investigations. Some tools for E-Trade's research could be complex for novice investors.

Etoro

The Etoro multi-asset marketplace allows you to trade CFDs and invest in equities.

Please be aware that CFDs are complex tools that carry a significant risk of dropping your money quickly due to the ratio. 76% of retail investors' accounts experience financial loss while using this supplier to trade CFDs.

It would help if you thought about your understanding of CFDs and your ability to bear the significant risk of dropping your money. The trading history is five whole years; thus, making an informed investment decision might be insufficient.

The portfolio management service, copy trading, is offered by eToro (Europe) Ltd., a company authorized and overseen by the Exchange Commission and Cyprus Securities.

Alpaca Trading

Alpaca Certainly LLC is a US-based trader offering commission-free trading API stock. It also provides the best API tools for ETF trading, stock for zero-commission and algorithmic trading, and the best charting tools along the web platform. Alpaca offers exceptional service for users committed to studying how to utilize the applications and the API. It is an excellent option for first-time investors.

However, Alpaca Trading has very little customer assistance. Therefore, it mainly relies on Slack, GitHub, and other online communities for customer service. Furthermore, only bank transfers are acceptable for deposits and withdrawals. Lastly, only U.S. stocks, and ETFs are included in their product list.

Schwab

No matter what you are and where you are, keep an eye on your finances and monitor the market. When and wherever you choose, you can easily keep an eye on your accounts, trade, study assets, and stay up to date on market news with the help of the Schwab mobile app.

Should You Use A SoFi Alternative For Investing?

Of course, yes! Investors and aggressive traders have several options, even though SoFi has earned a spot among the top in the individual finance services sector.

Commission-free trading is provided by almost all of the companies on this list. Nonetheless, one of these other possibilities is more appropriate for investors who need more, such as the capacity to trade options or do in-depth market research.

It all boils down to what qualities are most important to you. While you can trade stocks with any app, some could be more appropriate for your niche and long-term requirements than others.

Conclusion

In this article, we have mentioned the best Sofi investment alternative. Investors seek greater hands-on involvement, sophisticated trading tools, or more customizable portfolios. Investors who seek more excellent portfolio management without the hassles of active trading use the Sofi investment alternative.