-

Investment

InvestmentFabric Life Insurance – A Complete Review 2024

Fabric Life Insurance is one of the best insurance companies. If you want to know more about this company, then this review is for you.

Feb 07, 20243602 -

Investment

InvestmentA Practical Guide to Nike Stock Investment and Risk Navigation

Curious about investing in Nike stock? Uncover the why, how, and potential risks in this guide, empowering you with insights for a confident and human-centered investment journey.

Feb 05, 20248616 -

Investment

InvestmentThe Hanover Homeowners Insurance: A Comprehensive Review for 2024

Explore the comprehensive coverage options, customer service, claims process, and pricing of Hanover's homeowner insurance. Make an informed choice for your home's protection.

Feb 02, 20249275 -

Banking

BankingSBA 7(a) versus 504 Loans: Navigating the Financing Options for Your Business

Dive into the intricacies of SBA 7(a) and 504 Loans, understand their pros and cons, and discover which financing option aligns best with your business needs.

Jan 29, 20248780 -

Investment

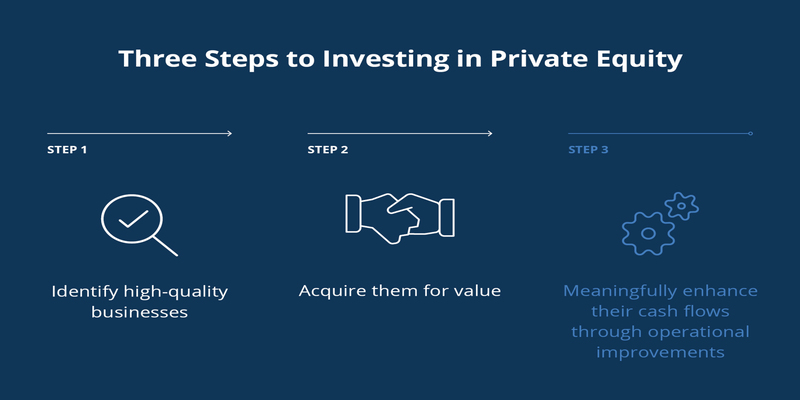

InvestmentWhich Are 3 Ways To Invest In Private Equity

Venture capital, Buyouts, and Growth Equity are the 3 ways to invest in private equity. Know about each of them in detail with us

Jan 27, 20248671 -

Banking

BankingUsing Payroll Loans: Strategic Uses and Important Considerations

A payroll loan may help you pay staff and keep your business running if profits drop. Read more about payroll loans.

Jan 27, 20249596 -

Banking

BankingThe Financial Shift: Rising Personal Loan Rates and Their Effect on Borrowers

Explore the factors influencing personal loan rates, understand the impact of the recent rise in these rates, and learn useful tips for borrowers navigating this financial shift.

Jan 25, 20242241 -

Know-how

Know-howWhat is SBA Loan Collateral and Guarantee – Major Differences

Are you curious to know the difference between SBA loan collateral and personal guarantee? This article has everything you need to know.

Jan 28, 20248791 -

Know-how

Know-howA Beginner's Guide to Overriding a Power of Attorney

Are you looking for a guide to find out who can override the power of attorney? Well, if that’s so, then give this article a read to understand it better.

Jan 26, 20243609 -

Investment

InvestmentDecoding Travel Insurance Refunds: Navigating the Maze of Claims

Unlock travel insurance refunds – learn to claim essentials for unexpected cancellations. We simplify the process in plain language.

Jan 22, 202427 -

Know-how

Know-howUnlocking a Higher Credit Card Limit: A How-To Guide

How can I increase my credit card limit? Follow our step-by-step guide to confidently seek a credit line increase and boost your financial freedom.

Jan 15, 20245626 -

Know-how

Know-howKey Steps in Purchasing an Existing Business

Discover the essentials of doing due diligence before investing in a business. Learn about assessing financial statements, understanding contracts, evaluating assets, and the importance of written negotiation.

Oct 06, 20234618 -

Investment

InvestmentHow to Refinnace an Investment Property

Looking for the right way to refinance an investment property? Find out what you need to know with this guide from How To Refinance An Investment Property. Get the facts and start planning today.

Dec 22, 20231118 -

Mortgages

MortgagesCash Basis Accounting vs. Accrual Accounting

Deciding between cash basis and accrual accounting for your business? Learn more about their differences and why one may be better suited for certain businesses than others with this professional guide!

Nov 04, 20233307 -

Know-how

Know-howWhat Does a Financial Consultant Do?

It's easy to become lost in the jargon when searching for a financial advisor to assist you in reaching your goals. A financial advisor is another common term.

Feb 19, 20241929 -

Know-how

Know-howWhen Should You File For Bankruptcy?

If you or your business have accumulated overwhelming debt and are considering bankruptcy, you can have a judge and a court trustee evaluate your assets and debts. At the discretion of the court, the obligations may be discharged. A debtor who has been "discharged" is no longer responsible for paying it back

Dec 19, 20232782 -

Mortgages

MortgagesWhat is Secured Personal Loans

The equity in your house can be used as collateral to get a loan. Discover the pros and cons of secured loans here so you can decide if they're good for you.

Feb 06, 20241616 -

Investment

InvestmentHow to use your HSA to invest

Health savings accounts, or HSAs, are becoming increasingly popular as a means to save for healthcare costs and retirement. According to a report by the Kaiser Family Foundation, by 2021, almost one-third of covered workers were enrolled in health insurance plans that included a savings option, up from 17 percent in 2011. The money you put away in one of these accounts can grow tax-free through investments.

Jan 30, 20249600 -

Banking

BankingEverything You Need To Know About Discover Bank CD Rates

Discover Online Banking is a part of Discover Financial Services, the firm most well-known for its innovative reward credit card. Accounts were first made available by Discover Online Banking in the year 2013

Nov 17, 20231417 -

Investment

InvestmentWhat must you keep in mind about Stock Index?

As perceived via indexes, the market is what people mean when they talk about the market moving up and down, alluding to a good or poor performance and turning bull versus bear. Multiple indices emerge because market sector indices don't all move in unison. The worth of a stock market segment may be estimated using the buy and sell prices of representative stocks to form an index. It's a way for financiers to characterize the marketplace and evaluate relative investment returns. For instance, the KSE-100 index tracks the performance of a basket of 100 representative equities traded on the Stock Exchange.

Dec 03, 20235393 -

Know-how

Know-howHow Cash-Out Refinancing Works And When To Use It

A homeowner might benefit from refinancing if they want to replace their current mortgage with a new one with more favorable conditions. The limited cash-out refinance, or the no cash-out refinance the one to go for if you don't want to cash out any equity. Limited cash-out refinancing and no cash-out refinancing are variations of the same rate-and-term refinance with different names

Dec 27, 20235911

-

Know-how

Know-howTravel Tips: Making the Right Choice Between Checked Bag and Carry-On

Feb 20, 2024 -

Banking

BankingAre Business Credit Cards Eligible for Credit Card Hardship Programs?

Feb 23, 2024 -

Know-how

Know-howMedigap Plan F Explained: Essential Information for Healthcare Planning

Feb 20, 2024 -

Mortgages

MortgagesCompare Financial Products — An Ultimate Guide

Feb 06, 2024 -

Investment

InvestmentSoFi Invest Alternative Suggestions You Won’t Regret Considering

Feb 05, 2024